Republic of the Philippines conventional short form. Ability to pay-off loan faster - With lower interest cost payable the loan tenure will be shorten.

Camels and performance eva luation of ba nks in Malaysia.

. مصرفية إسلامية or Sharia-compliant finance is banking or financing activity that complies with Sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture. Islam has a set of special moral norms and values about individual and social economic behavior. Shariah-compliant funds are considered to be a type of socially.

EIREPR 1413 to 2155 High disbursement loanfinancing amount up to RM 150000. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. Islamic Financial Services Act 2013 IFSA.

Low interestprofit rate from 800 pa. Key note address delivered by Governor of Bank Negara Malaysia Tan Sri Dato Sri Dr. Flexibility - Hassle free to make extra payments and withdrawal from your current account.

J Islamic Financ Bus Res21 36-45. This is because is considered interest a reward given to the saver. International reserves remain at comfortable levels and the banking system is stable.

CAMELS rating system in the context of Islamic banking. Therefore it has its own economic system which is based on its philosophical views and is compatible with the. THE CASE OF COMMERCIAL BANK OF.

However interest rate does play an effective means of attracting savings to the banking system. The study is limited to areas of Jaipur only. In an interest-free Islamic economy savers will still be rewarded.

Zeti Akhtar Azizs organised by the Institute of Islamic Banking and Insurances International. Enter the email address you signed up with and well email you a reset link. The key difference between Takaful and conventional insurance rests in the way the risk is assessed and handled as well as how the Takaful fund is managed.

With Maybank Home²u customers can virtually explore 76 property listings from more than 20 developers between RM250000 to RM2mil in attractive areas including in the greater Klang Valley and. A 2018 McKinseys Asia Personal Financial Services PFS survey reveals that digital banking penetration has grown 15 times to 3 times in emerging. Shariah-compliant funds are investment funds governed by the requirements of Shariah law and the principles of the Muslim religion.

Islamic banking Islamic finance Arabic. Customers Perception of Service Quality in Ethiopia banking sector. The sample size of only 133 was taken from the large population for the purpose of study so there can be difference between results of sample from total population.

Any banking system Islamic or otherwise will fail to attract savings without such rewards. COLLEGE OF BUSINESS AND ECONOMICS THE IMPACT OF SERVICE QUALITY ON CUSTOMER SATISFACTION. Sudden change in the e-banking practices during the course of research can affect the results.

Closer to home Bank Negara Malaysia BNM is set to issue up to five licenses to successful applicants to establish digital banks that conduct either a conventional or Islamic banking business. الاقتصاد الإسلامي refers to the knowledge of economics or economic activities and processes in terms of Islamic principles and teachings. This product has a fixed monthly payment schedule and is available under both Conventional and Islamic banking.

However this insurance coverage will be restricted when the new framework for deposit accounts takes effect in tandem with the phasing out of Mudharabah GIA under the Islamic Financial Services Act 2013. Cost savings on interest - With the concept and illustration above whenever you deposit or save into your current account your loan interest will be reduced. Numerous commercial vessels have been.

Islamic banking in Malaysia is also covered under the Perbadanan Insuran Deposits Malaysia. An emerging threat area lies in the Celebes and Sulu Seas between the Philippines and Malaysia where 11 ships were attacked in 2021. Conventional long form.

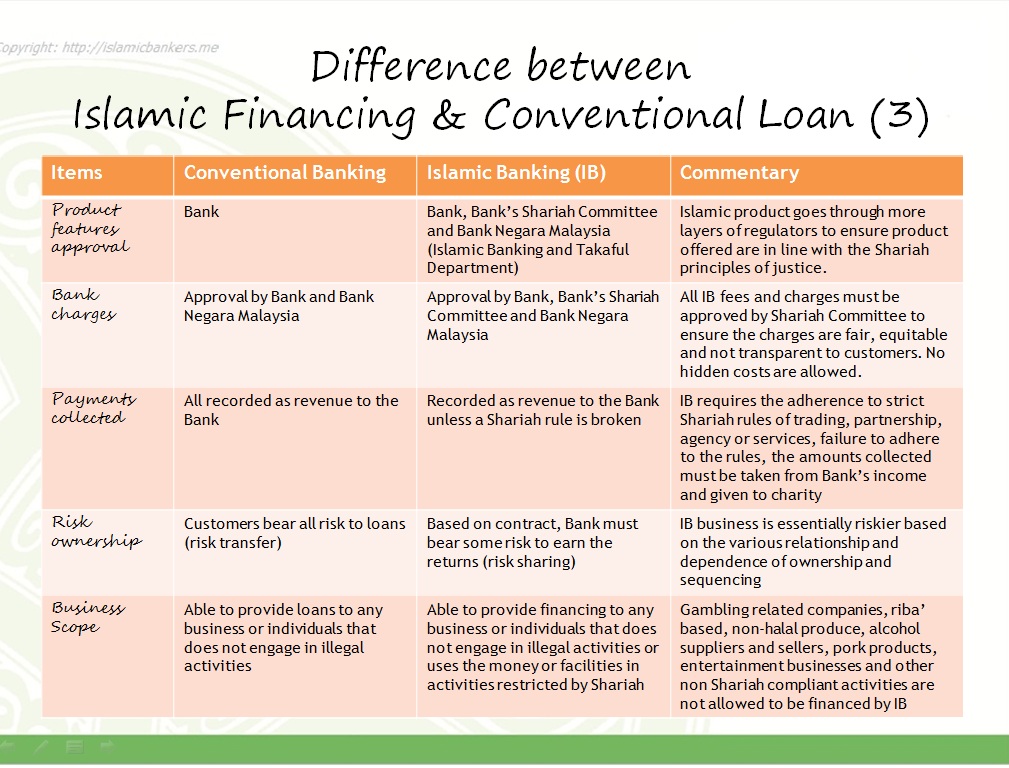

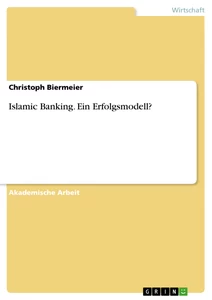

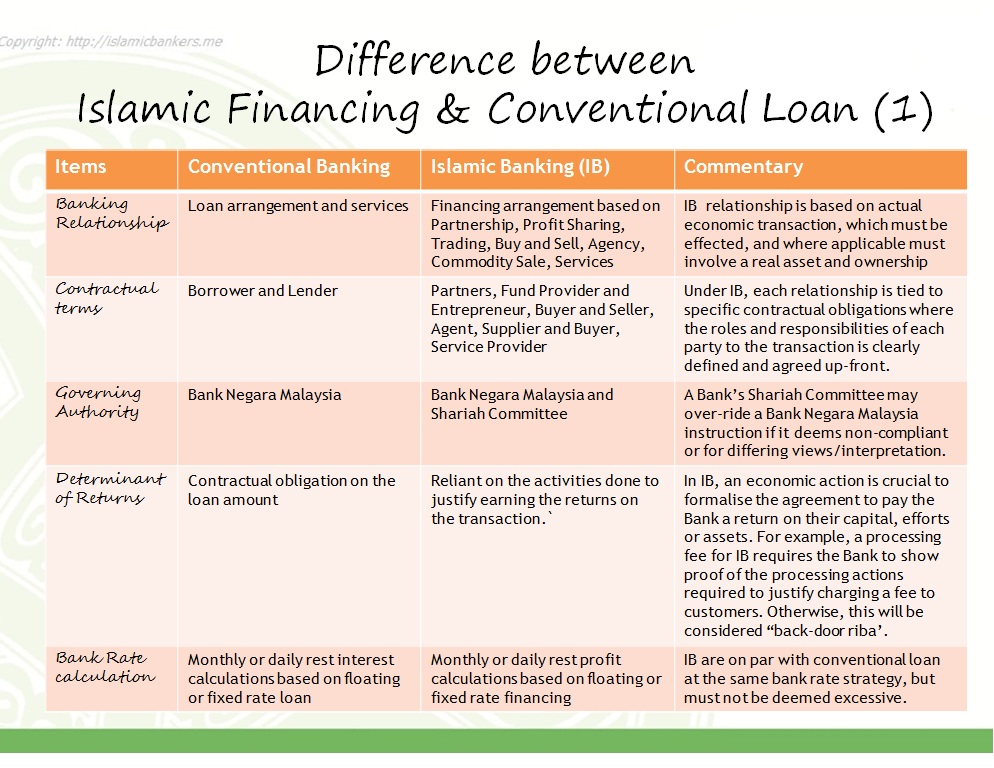

The Difference Between Islamic Banking Financing And Conventional Banking Loans Islamic Bankers Resource Centre

Pdf Issues Of Implementing Islamic Hire Purchase In Dual Banking Systems Malaysia S Experience Semantic Scholar

Lecture 2 Conventional Banking And Islamic Banking Systems

Differences Of Components In Balance Sheet Of Islamic And Conventional Download Table

Conventional Banking Vs Islamic Banking Comparative Analysis Of The Dynamics Of Operations Grin

Lecture 2 Conventional Banking And Islamic Banking Systems Ppt Download

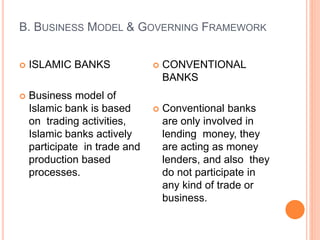

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

Conventional Banking Islamic Bankers Resource Centre

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

Pdf The Financial Performance Of Islamic Vs Conventional Banks An Empirical Study On The Gcc Mena Region Semantic Scholar

The Difference Between Islamic Banking Financing And Conventional Banking Loans Islamic Bankers Resource Centre

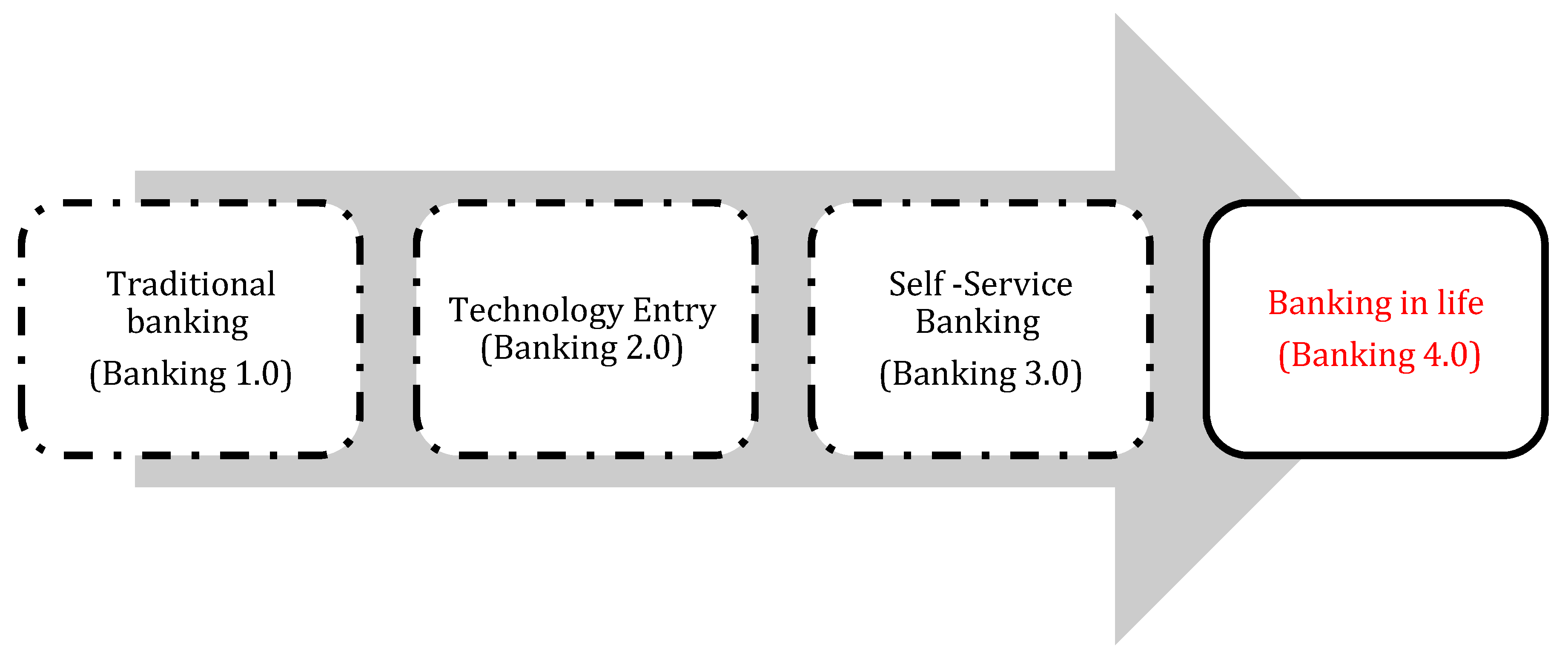

Ijfs Free Full Text Are We Ready For The Challenge Of Banks 4 0 Designing A Roadmap For Banking Systems In Industry 4 0 Html

Pdf An Empirical Investigation Into The Problems And Challenges Facing Islamic Banking In Malaysia Semantic Scholar

Challenges In Islamic Banking Islamic Bankers Resource Centre

Pdf An Empirical Investigation Into The Problems And Challenges Facing Islamic Banking In Malaysia Semantic Scholar

Pdf The Financial Performance Of Islamic Vs Conventional Banks An Empirical Study On The Gcc Mena Region Semantic Scholar

Risk Profile Of Conventional Vs Islamic Banks Download Table

Pdf Comparative Performance Study Of Conventional And Islamic Banking In Egypt Semantic Scholar

Islamic Banks Vs Conventional Banks